Slots sem investimentos

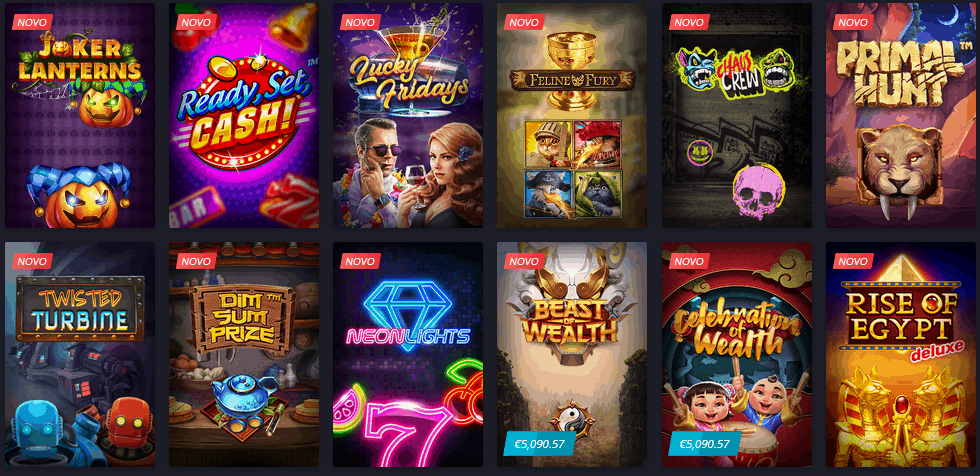

O nosso site foi criado com um objetivo em mente, que é ajudar jogadores como você a desfrutar dos jogos de casino que adora. Estamos constantemente a trabalhar para garantir que não tem de jogar em slots que não valem o seu tempo betfair casino bonus. Por isso, fique por cá e melhore os seus conhecimentos e capacidades aqui na BETO Slots.

Já na funcionalidade da compra de bónus, para além de evitar “perdas de tempo” aos jogadores que só querem jogar as rondas bónus, garante que o prémio resultante das rodadas grátis é superior às combinações nas rodadas normais.

Os jogadores experientes irão gostar ainda mais do nosso site porque partilhamos todos os detalhes técnicos que eles irão compreender, tais como a frequência de acertos das Rodadas Grátis de uma slot. Analisámos algumas das mais complicadas slot machines alguma vez criadas, como a Nitropolis 4 e a Dead Canary. Assim, pode ler sobre jogos avançados no nosso website, o que o fará esquecer os jogos mais simples destinados a novos jogadores.

Como é expectável, as slots de compra de bónus nos casinos online apresentam vantagens e desvantagens. Se por um lado a ronda bónus é mais emocionante, pode levar a esgotar o saldo rapidamente. Veja, os pontos fortes e inconvenientes que pode enfrentar na compra de bónus.

Levantamento de ganhos para o cartão

A promoção Multi Bónus aplica-se a apostas desportivas múltiplas vencedoras com pelo menos 5 seleções. A percentagem do bónus varia entre 5% e 50%, dependendo do número de seleções incluídas na aposta. Para serem elegíveis, as apostas devem respeitar requisitos mínimos de odd (1.20 por seleção) e valor (2€).

Além disso, o Multibanco oferece uma gama de serviços adicionais que vão além das transações bancárias tradicionais. É possível pagar faturas, recarregar telemóveis e até fazer compras em alguns estabelecimentos, tudo com poucos cliques. A familiarização com essas funcionalidades não só facilita o dia a dia, mas também proporciona uma experiência mais completa e integrada nas finanças pessoais. Conhecer as regras do Multibanco é, portanto, um passo importante para maximizar os benefícios desse sistema.

A plataforma também implementa múltiplas firewalls, proporcionando uma camada adicional de proteção contra ameaças externas. Além disso, a tecnologia SSL (Secure Sockets Layer) é utilizada para garantir que todas as informações transmitidas entre o utilizador e a plataforma sejam cifradas, reduzindo significativamente o risco de acesso não autorizado. Estas medidas são parte do compromisso do Placard com a segurança dos seus utilizadores.

Para maximizar seus saques de forma inteligente, é essencial entender os diferentes tipos de contas e investimentos disponíveis. Avaliar as taxas de rendimento e a liquidez dos produtos financeiros pode fazer toda a diferença na hora de retirar seus ganhos. Considere diversificar suas aplicações, equilibrando entre opções de maior retorno e aquelas que garantam segurança e fácil acesso ao seu dinheiro. Assim, você poderá desfrutar de um fluxo de caixa saudável sem abrir mão de oportunidades de crescimento.

Depois de enviar o comprovativo, verifique se todos os dados da conta estão corretamente inseridos. Com a validação concluída, basta selecionar o valor que deseja para levantar dinheiro no Placard e submeter a solicitação. O levantamento será então processado e ficará pendente até ser aprovado, normalmente até 48 horas.

Pagamentos seguros

Forward-looking information involves known and unknown risks and uncertainties, many of which are beyond our control, that could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking information. These risks and uncertainties include, but are not limited to, the risk factors described in greater detail under “Risk Factors” of the Company’s annual information form (“AIF”) and the “Risk Factor’s” in the Company’s management’s discussion and analysis of financial condition and results of operations for the three and nine months ended September 30, 2024 (“MD&A”), such as: risks relating to our business, industry and overall economic uncertainty; the rapid developments and change in our industry; substantial competition both within our industry and from other payments providers; challenges implementing our growth strategy; challenges to expand our product portfolio and market reach; changes in foreign currency exchange rates, interest rates, consumer spending and other macroeconomic factors affecting our customers and our results of operations; challenges in expanding into new geographic regions internationally and continuing our growth within our markets; challenges in retaining existing customers, increasing sales to existing customers and attracting new customers; reliance on third-party partners to distribute some of our products and services; risks associated with future acquisitions, partnerships or joint-ventures; challenges related to economic and political conditions, business cycles and credit risks of our customers, such as wars like the Russia-Ukraine and Middle East conflicts and related economic sanctions; the occurrence of a natural disaster, a widespread health epidemic or pandemic or other similar events; history of net losses and additional significant investments in our business; our level of indebtedness; challenges to secure financing on favorable terms or at all; difficulty to maintain the same rate of revenue growth as our business matures and to evaluate our future prospects; inflation; challenges related to a significant number of our customers being small and medium businesses (“SMBs”); a certain degree of concentration in our customer base and customer sectors; compliance with the requirements of payment networks; reliance on, and compliance with, the requirements of acquiring banks and payment networks; challenges related to the reimbursement of chargebacks from our customers; financial liability related to the inability of our customers (merchants) to fulfill their requirements; our bank accounts being located in multiple territories and relying on banking partners to maintain those accounts; decline in the use of electronic payment methods; loss of key personnel or difficulties hiring qualified personnel; deterioration in relationships with our employees; impairment of a significant portion of intangible assets and goodwill; increasing fees from payment networks; misappropriation of end-user transaction funds by our employees; frauds by customers, their customers or others; coverage of our insurance policies; the degree of effectiveness of our risk management policies and procedures in mitigating our risk exposure; the integration of a variety of operating systems, software, hardware, web browsers and networks in our services; the costs and effects of pending and future litigation; various claims such as wrongful hiring of an employee from a competitor, wrongful use of confidential information of third parties by our employees, consultants or independent contractors or wrongful use of trade secrets by our employees of their former employers; deterioration in the quality of the products and services offered; managing our growth effectively; challenges from seasonal fluctuations on our operating results; changes in accounting standards; estimates and assumptions in the application of accounting policies; risks associated with less than full control rights of some of our subsidiaries and investments; challenges related to our holding company structure; impacts of climate change; development of AI and its integration in our operations, as well as risks relating to intellectual property and technology, risks related to data security incidents, including cyber-attacks, computer viruses, or otherwise which may result in a disruption of services or liability exposure; challenges regarding regulatory compliance in the jurisdictions in which we operate, due to complex, conflicting and evolving local laws and regulations and legal proceedings and risks relating to our Subordinate Voting Shares. In addition, if the transaction is not completed, and the Company continues as a publicly-traded entity, there are risks that the announcement of the Proposed transaction and the dedication of substantial resources of the Company to the completion of the transaction could have an impact on its business and strategic relationships (including with future and prospective employees, customers, suppliers and partners), operating results and activities in general, and could have a material adverse effect on its current and future operations, financial condition and prospects. Furthermore, in certain circumstances, the Company may be required to pay a termination fee pursuant to the terms of the arrangement agreement which could have a material adverse effect on its financial position and results of operations and its ability to fund growth prospects and current operations.

MONTREAL, 24 de setembro de 2024 – A Nuvei Corporation (“Nuvei” ou a “Empresa”) (Nasdaq: NVEI) (TSX: NVEI), a empresa canadense de fintech, anunciou hoje o lançamento de vários novos recursos e aprimoramentos para seu produto Nuvei for Platforms.

O Google Pay está se tornando um método de pagamento essencial para os comerciantes on-line em todo o mundo. A integração do Google Pay à solução de caixa da Nuvei atende às preferências em evolução dos consumidores com experiência digital.

Ao contrário de outros emissores de cartões, a plataforma unificada de pagamentos da Nuvei une a aquisição e a emissão de cartões, garantindo que os fundos fluam sem problemas em sua empresa, sem atrasos.

Forward-looking information involves known and unknown risks and uncertainties, many of which are beyond our control, that could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking information. These risks and uncertainties include, but are not limited to, the risk factors described in greater detail under “Risk Factors” of the Company’s annual information form (“AIF”) and the “Risk Factor’s” in the Company’s management’s discussion and analysis of financial condition and results of operations for the three and nine months ended September 30, 2024 (“MD&A”), such as: risks relating to our business, industry and overall economic uncertainty; the rapid developments and change in our industry; substantial competition both within our industry and from other payments providers; challenges implementing our growth strategy; challenges to expand our product portfolio and market reach; changes in foreign currency exchange rates, interest rates, consumer spending and other macroeconomic factors affecting our customers and our results of operations; challenges in expanding into new geographic regions internationally and continuing our growth within our markets; challenges in retaining existing customers, increasing sales to existing customers and attracting new customers; reliance on third-party partners to distribute some of our products and services; risks associated with future acquisitions, partnerships or joint-ventures; challenges related to economic and political conditions, business cycles and credit risks of our customers, such as wars like the Russia-Ukraine and Middle East conflicts and related economic sanctions; the occurrence of a natural disaster, a widespread health epidemic or pandemic or other similar events; history of net losses and additional significant investments in our business; our level of indebtedness; challenges to secure financing on favorable terms or at all; difficulty to maintain the same rate of revenue growth as our business matures and to evaluate our future prospects; inflation; challenges related to a significant number of our customers being small and medium businesses (“SMBs”); a certain degree of concentration in our customer base and customer sectors; compliance with the requirements of payment networks; reliance on, and compliance with, the requirements of acquiring banks and payment networks; challenges related to the reimbursement of chargebacks from our customers; financial liability related to the inability of our customers (merchants) to fulfill their requirements; our bank accounts being located in multiple territories and relying on banking partners to maintain those accounts; decline in the use of electronic payment methods; loss of key personnel or difficulties hiring qualified personnel; deterioration in relationships with our employees; impairment of a significant portion of intangible assets and goodwill; increasing fees from payment networks; misappropriation of end-user transaction funds by our employees; frauds by customers, their customers or others; coverage of our insurance policies; the degree of effectiveness of our risk management policies and procedures in mitigating our risk exposure; the integration of a variety of operating systems, software, hardware, web browsers and networks in our services; the costs and effects of pending and future litigation; various claims such as wrongful hiring of an employee from a competitor, wrongful use of confidential information of third parties by our employees, consultants or independent contractors or wrongful use of trade secrets by our employees of their former employers; deterioration in the quality of the products and services offered; managing our growth effectively; challenges from seasonal fluctuations on our operating results; changes in accounting standards; estimates and assumptions in the application of accounting policies; risks associated with less than full control rights of some of our subsidiaries and investments; challenges related to our holding company structure; impacts of climate change; development of AI and its integration in our operations, as well as risks relating to intellectual property and technology, risks related to data security incidents, including cyber-attacks, computer viruses, or otherwise which may result in a disruption of services or liability exposure; challenges regarding regulatory compliance in the jurisdictions in which we operate, due to complex, conflicting and evolving local laws and regulations and legal proceedings and risks relating to our Subordinate Voting Shares. In addition, if the transaction is not completed, and the Company continues as a publicly-traded entity, there are risks that the announcement of the Proposed transaction and the dedication of substantial resources of the Company to the completion of the transaction could have an impact on its business and strategic relationships (including with future and prospective employees, customers, suppliers and partners), operating results and activities in general, and could have a material adverse effect on its current and future operations, financial condition and prospects. Furthermore, in certain circumstances, the Company may be required to pay a termination fee pursuant to the terms of the arrangement agreement which could have a material adverse effect on its financial position and results of operations and its ability to fund growth prospects and current operations.

MONTREAL, 24 de setembro de 2024 – A Nuvei Corporation (“Nuvei” ou a “Empresa”) (Nasdaq: NVEI) (TSX: NVEI), a empresa canadense de fintech, anunciou hoje o lançamento de vários novos recursos e aprimoramentos para seu produto Nuvei for Platforms.

Sorteio do jackpot

O Euromilhões consiste num jogo de Apostas Mútuas do tipo “Loto”, com prognósticos sobre números: os apostadores prognosticam o resultado sobre o acerto de 5 números em 50 possíveis, na grelha de “Números”, e o acerto de 2 números/estrelas em 12 possíveis, na grelha das “Estrelas” – A probabilidade média de ganho de um qualquer prémio é de 1 para 13.

Para ganharem o primeiro prémio do Eurojackpot os jogadores deverão acertar em todos os 5 números principais e nos 2 números Euro. Na eventualidade de ninguém conseguir acertar em todos os 7 números o Jackpot transita para o sorteio seguinte. Isto repete-se em cada semana até que seja alcançado o valor máximo de jackpot de 90 milhões de euros.

O fundo do jackpot para os Supersorteios do Euromilhões é subsidiado pelo EuroMillions Booster Fund do Euromilhões (Fundo de Impulso), que recebe 10% do Fundo do Prémio Comum de cada sorteio regular do Euromilhões.

A ideia básica por trás do EuroJackpot é simples: quanto mais países participam, maior e mais atraente ele se torna tornam-se os jackpots. E isso funcionou! Desde a sua introdução, a popularidade da Eurolotto continuou a crescer ganhos, e os jackpots são muitas vezes enormes, com ganhos que podem atingir os 120 milhões de euros.

Uma visão económica e política do país e do mundo. Exclusiva. Com assinatura. Só os membros desta comunidade têm acesso. Para decidir de forma informada, e antes dos outros. Não queremos assinantes, queremos membros ativos da comunidade.